On the surface, transportation is a contract-driven industry. As shippers (think consumer packaged goods or food and beverage companies) and carriers both know, however, even the best-negotiated contracts are capable of failing in the face of freight market volatility. That’s where the spot market comes into play.

Contract and spot rates move in tandem with each other. These shifts are a direct result of both freight market and overall economic trends. Understanding the differences between contract and spot markets can go a long way in helping folks navigate the freight market without losing sight of the bigger picture.

Contract rates

Contract rates represent negotiated agreements between shippers and carriers. These rates are based on market conditions at the time the contract is written, as well as available future projections. The freight market is characterized by volatility, however, and predicted rate trends are often wrong. This leads to out-of-date contract rates, ultimately driving either the shipper or carrier to abandon the contract prematurely in order to take advantage of quick-moving spot rates.

While shippers once universally performed their request for proposals on an annual basis, emerging technologies — coupled with extreme pandemic-fueled volatility — have inspired a significant subset of players to issue shorter, more flexible contracts. These alternative RFPs create a pathway for contract rates to react to market changes on a near-time basis, ideally increasing compliance by all parties.

Spot rates

Unlike contract rates, spot rates reflect real-time market conditions. Spot rates can nose-dive or skyrocket in response to predictable factors, like peak retail season, or unpredictable factors, like a natural disaster or global health pandemic.

These lightning-fast reactions make spot rates a direct reflection of supply and demand in the goods economy.

The same thing that makes these rates alluring — their timeliness — also makes them dangerous. While shippers or carriers — depending on the market — may be able to bulk up their bottom line in the short term by going to the spot market, these companies run the risk of losing those gains during the next market turn.

Relationship between rate types

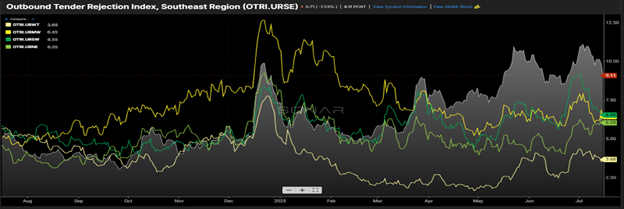

As spot rates fall, the contract market follows on its heels. As spot rates rise, so do contracts. This is because, in the case of a falling spot market, shippers have buying power and can get loads picked up more cheaply or because, in the case of a rising spot market, carriers have the power and can decline loads for more attractive alternatives.

Contract rates tend to climb during periods of loose capacity, when shippers have the pricing power and carriers are just trying to keep their trucks loaded. Because carrier rejection rates are lowest during these conditions, spot rates drop. Tight capacity markets lead to increased spot rates because carriers are more likely to reject contracted loads, leaving shippers scrambling to get their loads covered, even at higher rates.

Despite this well-established trend, abandoning contracts is a dangerous game for carriers. Generally, both parties are better off honoring their contracts in the long run. While this may mean leaving money on the table in the short term, it ultimately leads to stronger partnerships.

Strong shipper-carrier relationships are a crucial part of keeping the transportation industry running. When carriers honor their contracts — even when the spot market offers better short-term deals — they increase the chances that their partners will continue doing competitive business with them when the market inevitably turns. In this way, missing out on of-the-moment savings can actually lead to increased long-term gains.

Need access to reliable daily spot pricing? Want to streamline RFP processes? Schedule a free consultation to see how FreightWaves SONAR can help you improve rate accuracy and leverage spot rates at tender to negotiate, buy and sell capacity.