The Union Pacific and Norfolk Southern management teams spent much of Tuesday’s analyst call making the case that the deal was in the public’s interest – one of the conditions for the Surface Transportation Board’s approval, in addition to competition enhancement. It did this primarily by highlighting how the deal could take trucks off the road. That has implications for not only rail, but also the long-haul truckload market and port market share, all of which will show up in SONAR data. The current Surface Transportation Board timeline for approval is up to 19-22 months. It’s also likely that BNSF will announce a merger with CSX in that time, bringing another transcontinental railroad to the market and further contributing to the trends described below.

Intermodal to gain share from long-haul truckload

Rail intermodal (white line – includes international and domestic containers) has taken share from long-haul truckload (tender volume for loads exceeding 800 miles in yellow) in the past year largely due to an import pull-forward associated with tariffs. Transcontinental rail mergers may lead to intermodal taking share on a more secular basis. (Chart: SONAR)

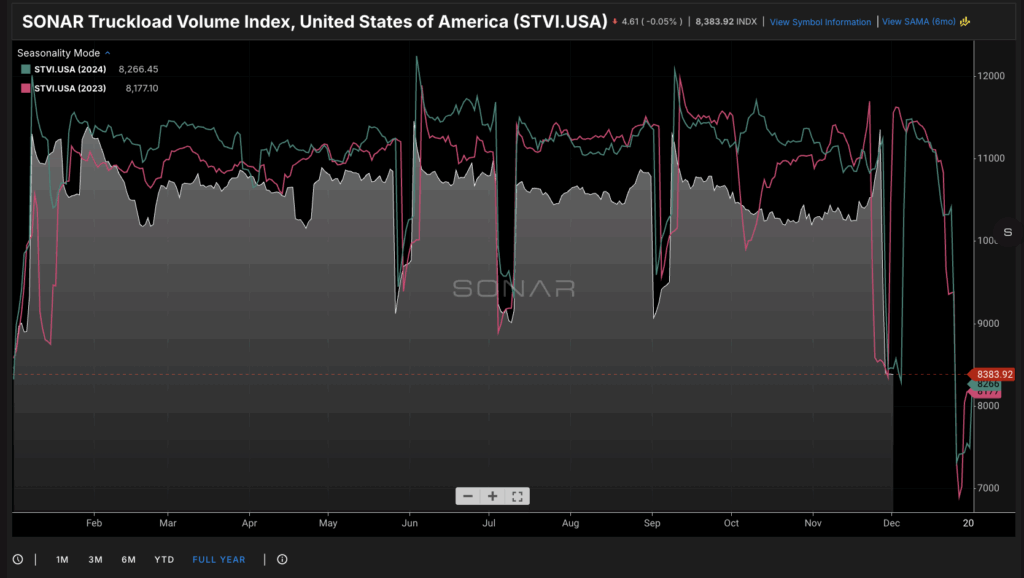

In recent months, the FreightWaves and SONAR teams have frequently discussed intermodal taking share from long-haul truckload. But, those comments pertained to the period from late last year and early this year. Tariffs pulled freight forward, reducing time sensitivity and thus improving intermodal’s value proposition. Over a longer timeframe of the past several years, intermodal has lost share to the highway, ending, or at least pausing, its historical staus as a growth area. That dynamic will likely push carriers further into shorter haul lanes.

Opens up new lanes to intermodal

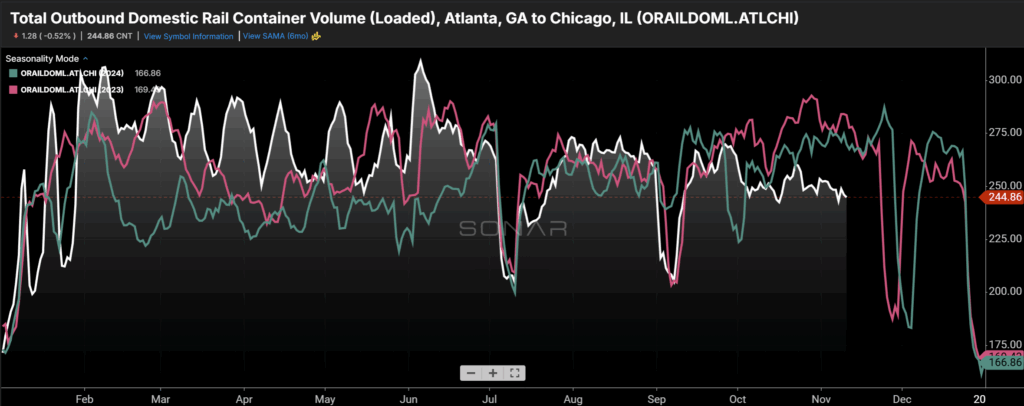

Going forward, the deal could breathe new life into intermodal volume by opening up lanes where there are currently too many barriers to tip the scales in intermodal’s favor. Currently, intermodal volume that is interchanged is dominated by lengths of haul exceeding 2,000 miles. One example given on Tuesday’s call is that there is very little intermodal volume between Dallas and Columbus despite the cities being one of the largest population centers and distribution centers, respectively. That’s because interchanging is burdensome. Houston to Charlotte was another example given, among other city pairs on opposite sides of the Mississippi River. SONAR shows that the intermodal volume in the DAL-CMH AND the HOU-CLT lanes is currently negligible. Refrigerated intermodal was not mentioned on the analyst call Tuesday, but one has to wonder whether the deal will spur that niche to higher volume; refrigerated containers currently represent about 4% of the domestic intermodal container fleet.

Improved intermodal service

SONAR shows current intermodal savings rates of 25% and 17% for an index of outbound-LA transcontinental lanes and an index of local east lanes, respectively, which includes modal differences in fuel surcharges. If service levels between truckload and intermodal come closer to parity, rates likely would as well. (Chart: SONAR)

Some rail carload shippers’ interest groups, such as those representing chemical manufacturers, immediately came out against the deal due to concerns over industry concentration and service levels. But intermodal has very different dynamics, and service levels may improve in that sector. According to Union Pacific, interchanges can slow transit time down by 24-36 hours. A common bogey for intermodal service is “truckload plus a day.” A faster transit time could potentially make intermodal service at parity with, or even faster than, truckload. That, in turn, could change the savings that shippers would require to utilize rail intermodal over truckload. And, intermodal service is about more than just speed; it’s about consistent and reliable transit times, both of which should improve with fewer interchanges and points of handling.

Shifts in port market share

Import volume at the Port of Houston has grown at an above-market rate in the past five years. Greater intermodal routing optionality may accelerate that. (Chart: SONAR)