Modern supply chains are data-generating enterprises. And today’s companies have an opportunity to apply freight market intelligence tools and resources to shift the competitive advantage in their favor, overcome obstacles that arise due to industrial growth, and realize benefits regardless of their position within the market.

“Knowledge is knowing what the most recent rate was on a lane. Intelligence is knowing how the market conditions on that lane are moving and how that impacts rates.” – SONAR Sales Team.

Let’s take a closer look at how freight market analyses and intelligence can make efficiency in freight shipments possible and their implications for supply chain improvements.

The challenges of managing freight without an intelligence tool

Unfortunately, the capacity for freight data and making sense of it to derive the most value do not always align well. As the Supply Chain Shaman, Lora Cecere states in her recent article Dealing With The Supply Chain Gloppy Mess, “During this pandemic, sensing market changes, using data, and driving decisions at the speed of business matters more than ever. Companies are drowning in data and short on insights. Traditional processes aren’t equal to the wild swings of the market. Pre-pandemic, only 30% of supply chain leaders were satisfied with their supply chains, and during the pandemic, business leader satisfaction is falling precipitously. Most are struggling to find consultants to help.”

Failure to manage data and apply it accordingly will lead to an inevitable result – higher total landed cost and an inability to ensure competitive freight rates. In other words, undervaluing or overvaluing one’s position within the freight market will lead to lost opportunities to increase revenue. For instance, poor access and understanding of data across all modes and carriers make using intermodal transit a lost cause as access to insights may uncover intermodal is not the right mode one should choose. But the application of the right data in a timely manner can transform intermodal into an opportunity to save resources, eliminate delays and much more. Freight intelligence tools help to change the cacophony of noise into a unified freight strategy.

Freight market intelligence applies historical and real-time data to generate meaningful insights

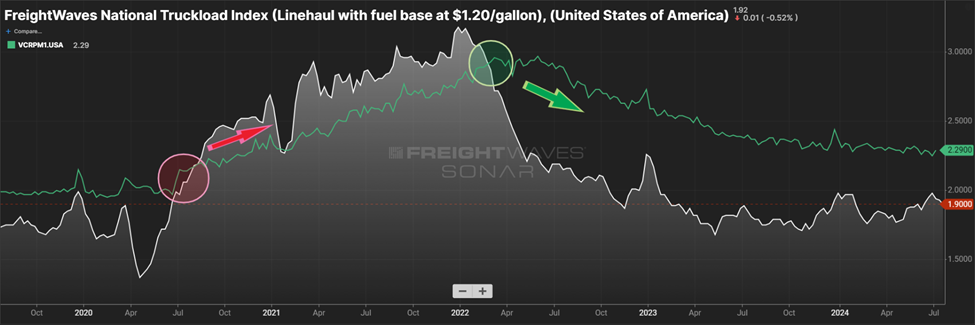

Freight market intelligence leverages millions of data points and historical and real-time insights to derive actionable insights. That is a fancy way of saying that any use of data and its analytical insights can evolve into a beacon that shows what a company needs to succeed when it’s time to consider freight bidding strategies and whether the company’s existing trading relationships are genuinely reflective of the market. Moreover, companies around the globe are working to fend off one of the most significant capacity crunches in history. And the ability to apply freight market intelligence is essential to optimizing existing resources, allocating assets, planning inventory strategies, and much more. The current freight market outlook is among the most whiplash-driven events in supply chain history. Outbound volumes and rejections are hitting historical highs, driven in part by the economic activity around the coronavirus pandemic. The only way forward is through the use of freight market intelligence and informed decision-making.

How freight market intelligence benefits freight management parties

Applying a freight market business intelligence tool to make informed decisions offers core benefits to all freight management parties. For example, consider how these segments realize increased potential through data-driven freight market analyses and insights:

- Brokers realize the benefits of freight market intelligence in the form of improved client service ratings, increased bookings, fewer tender rejections by carriers and more productivity

- Shippers derive value from freight market intelligence by reallocating inventory to markets with ample outbound and inbound capacity, offering more competitive rates for tendered freight, and avoiding soaring tender rejections

- Carriers add value to operational efficiency through market data by offering the most competitive rates for each unique set of market conditions, moving beyond a global or domestic standard for all rates and tailoring rates to each area

- 3PLs blend the benefits of all other freight management segments to better position themselves as competitive resource providers that work across carriers, shippers and brokers to secure more capacity, diversify supplier relationships and overcome obstacles as they arise

Deploy freight market intelligence with a freight forecasting platform now

Freight forecasting has always focused on knowing what’s happening in the market and responding accordingly. By leveraging a freight forecasting engine to unlock efficiencies, see the market trends before they occur, and navigate the growing complexities of global supply chains, all freight management parties can maximize value and stay competitive. Start by knowing where you stand, and finish by acting on that information with the right freight forecasting and monitoring strategy. And FreightWaves SONAR can help you find that needed information.

Request a SONAR demo online to learn more about how freight market intelligence can create data-driven decision-making in your organization today.