The inauguration of recent tariff policies has created turbulence in global trade, affecting supply chains on multiple fronts. As tariffs influence trucking, ocean freight, air cargo and warehousing, supply chain professionals face unprecedented volatility. To address these challenges, high-frequency freight data emerges as an essential tool for real-time decision-making and strategic adaptability.

The landscape of tariffs: Recent tariff changes have profoundly impacted various sectors. For instance, with tariffs on North American trade, Canadian trucking capacity has tightened, and U.S. flatbed rejection rates have increased. Similarly, shifts are evident in ocean and air cargo rates, driven by geopolitical actions and seasonal trends. These developments underscore the need for accurate and immediate data to navigate such disruptions effectively.

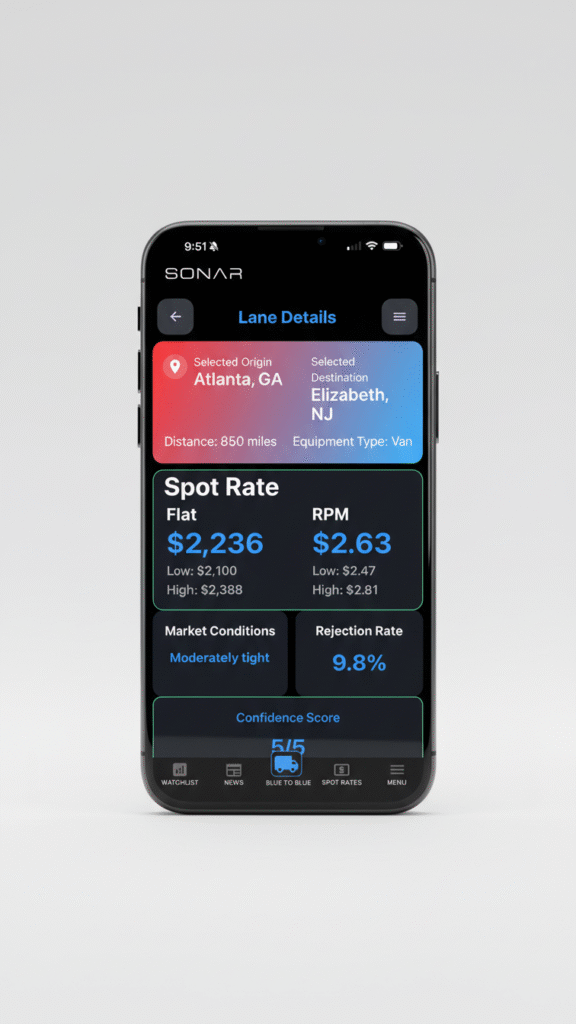

The role of SONAR data: SONAR, as the leading freight industry data platform, provides indispensable insights that empower industry players to adapt swiftly. Carriers can optimize routes and avoid delays, while shippers can foresee shifts in capacity and secure favorable rates. Brokers benefit from tracking capacity and pricing trends, maintaining their significance in the supply chain ecosystem.

Market reactions and strategic implications: Market responses to tariff policies demonstrate the volatility and uncertainty faced by supply chain professionals. For example, import pull-forwards highlight the anticipation of cost hikes, while adjustments in global manufacturing locations reflect strategic efforts to mitigate impacts. This dynamic landscape necessitates the use of high-frequency data to maintain a competitive edge.

Real-world applications: High-frequency data is not just a convenience; it is a necessity. By providing real-time market visibility, data-driven platforms help professionals mitigate risk and capitalize on opportunities. Whether dealing with increased import volumes, trucking capacity constraints or shifting manufacturing bases, high-frequency data allows for agile and informed decision-making.

Conclusion: The ever-evolving tariff environment and its implications for the supply chain demand a robust response. High-frequency freight data equips professionals with the insights needed to navigate these complexities and sustain a competitive advantage. As global trade continues to face uncertainties, data-driven strategies will be crucial in ensuring resilience and success in the freight industry.

To learn more about SONAR, visit gosonar.com or request a demo.