Carriers and transportation experts are always looking for ways to cut costs and maximize spending. Let’s face it. Everyone wants lower overhead. But more analyses are a hard-sell for busy logistics managers. According to Talking Logistics with Adrian Gonzalez, “Transportation professionals are so consumed with managing immediate needs that it’s often difficult for them to step back and consider longer term strategic objectives.” A freight spend analysis can help cut those extra costs. By doing so, carriers and experts pinpoint logistics cost contributors. Performing a freight spend analysis reveals extra costs deriving from unforeseen issues. This saves logistics business professionals time and money in the long term. Let’s look at a few best practices and steps to conduct a comprehensive, insightful cost analysis.

1. Know the scope and value of a freight spend analysis

The first step to conducting a freight spend analysis is knowing the ups and downs of any analysis. A freight spend analysis takes a thorough look into everything over a duration. The analysis evaluates asset use, performance, throughput, baseline deviations and other focal points. Successful analyses also create insights into hidden fees and identify areas of concern. Transportation leaders must audit and analyze spending to keep it under control. A lack of data is the absolute villain in this scenario for brokers and all trading parties.

2. Start where it all begins – procurement

Procurement remains an oft-overlooked side of a freight spend analysis. All forward and reverse costs should be considered within a comprehensive spend analysis. That’s the only way to understand the real costs of transportation in your enterprise.

3. Gather data for the analysis

The next step of a freight spend analysis is using technology, such as API, EDI, or other webhooks to collect transportation data, coming from electronic tenders, TMS systems, ELDs, telematics, fuel purchasing systems, truckload carrier accounting systems, customs, bill of lading data, and many others. Additionally, integrations into telematics for real-time data or connecting via IOT-enabled sensors bridge the disparities in various network assets, including equipment and individual pallets. RFID tags or low-energy Bluetooth sensors can provide item-level visibility for all moves. This allows carriers and transportation experts to check anything in real-time. Shipping delays or other issues can become a huge problem, leading to lost customers.

Real-time data use, fed into an overarching freight analytics platform, reduces the prevalence and severity of these incidences. And by using devices connected to multiple systems using technologies like API or the IoT, a company gains more visibility. Increased visibility lends itself to easier freight spend analysis and application of insights.

4. Use analytics to understand what happened and why

Descriptive and diagnostic analytics are additional analytics tools that can help. They provide insight into freight spend on large and granular scales.

For instance, it’s useful to gain insight into multiple factors at once, such as:

- Trucking spot freight rates.

- Contracted freight trends.

- Current truck equipment orders.

- Outbound and inbound data.

Descriptive analytics tracks the past. But diagnostic analytics show why they happened.

The derived insights help enterprises prevent the recurrence of those issues. Thus, predictive and prescriptive analytics tools become useful in proactive spend management. These analytics-driven insights will ensure the most cost-effective measures are taken first as well.

An individual analytics’ type does not paint a full picture of logistics costs. That’s why it’s important to use the full lineup of analytics to understand true logistics costs. Freight spend analysis relies on accurate, proficient software to perform checks and balances. Still, users must interpret, share and act upon the issue.

5. Generate meaningful reports and actionable intelligence

Knowing where you stand is only part of the battle. Your team will not necessarily know what the data means. Instead, it’s ideal to transform raw data into meaningful insights, such as core supply chain KPIs. These metrics, including warehouse KPIs, help companies achieve transportation optimization.

6. Compare findings to industry trends

It’s important to compare freight spend analysis results against industry benchmarks. Benchmarking helps determine how well business intelligence findings align with market trends. And by acting on the data, leaders can undertake new initiatives. That’s invaluable for sourcing more capacity and staying competitive

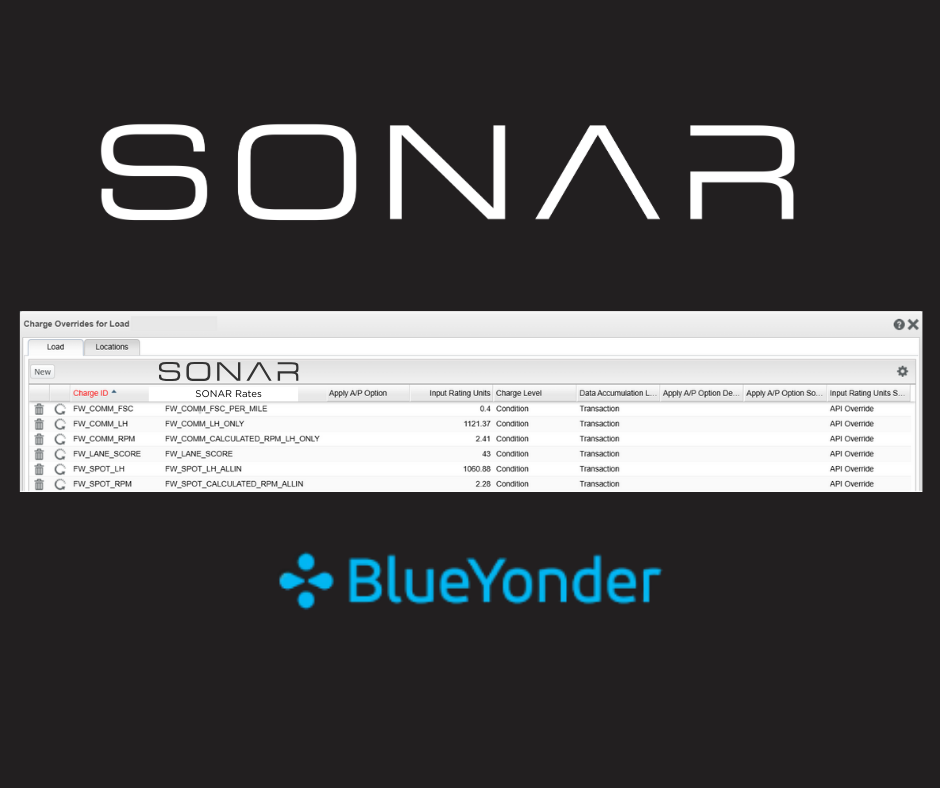

Get the data-driven insights needed with the right resources

All these components are important to gain the data-driven insights needed. With the right resources, the company can stay competitive, lower costs and spending, and prevent detrimental issues. Conduct freight analysis at regular intervals. And do not forget to educate all employees on what’s happening and why. That’s essential to ensure deadline adherence and uninterrupted workflows. Be in the know; do the most for your business and request a FreightWaves SONAR demo to get started.