The fourth quarter is the time of year the transportation industry always looks forward to. Retail peak season typically kicks off with back-to-school shopping and reaches its peak during the holiday rush with Black Friday and Cyber Monday. The retail holiday season is when time sensitivity tends to ramp up, demand is at or near the highest level of the year, and capacity comes off the road for the holidays. For shippers and carriers alike, this translates into tighter capacity, higher rates and an urgent need for precision in delivery timing.

The freight market continues to battle the freight recession that has been ongoing for over two years, and there have been signs that the market is slightly more sensitive to outside events. The most impactful outside event, the holidays, is on the horizon and businesses are gearing up to meet increased consumer demand while navigating the complexities of supply chains. Within SONAR, the Outbound Tender Reject Index (blue) In early October eclipsed 5% for the first time since the Fourth of July holiday. At the same time, the Outbound Tender Volume Index (white) has yet to move meaningfully higher, despite record import levels.

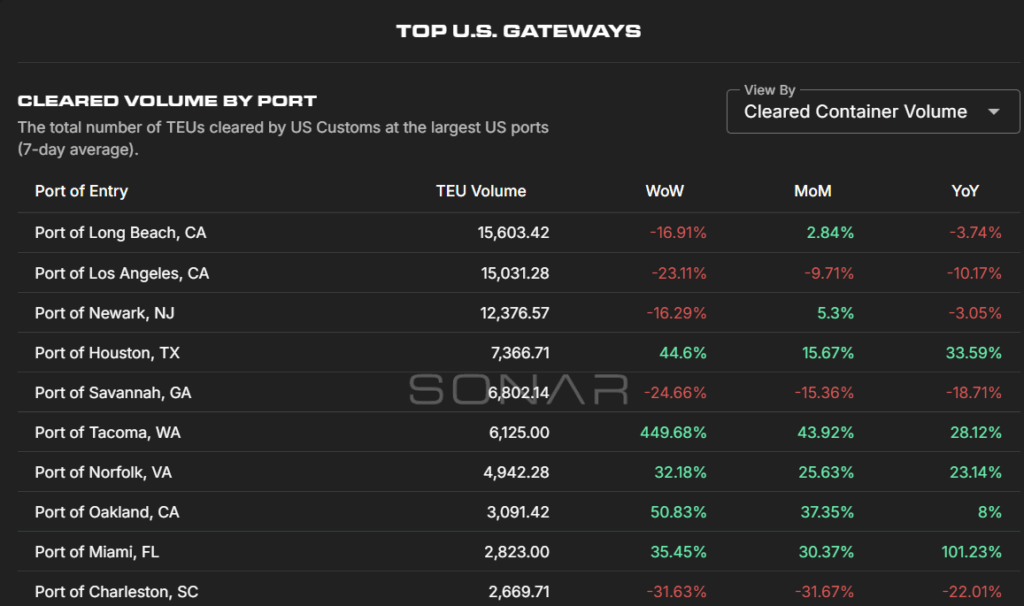

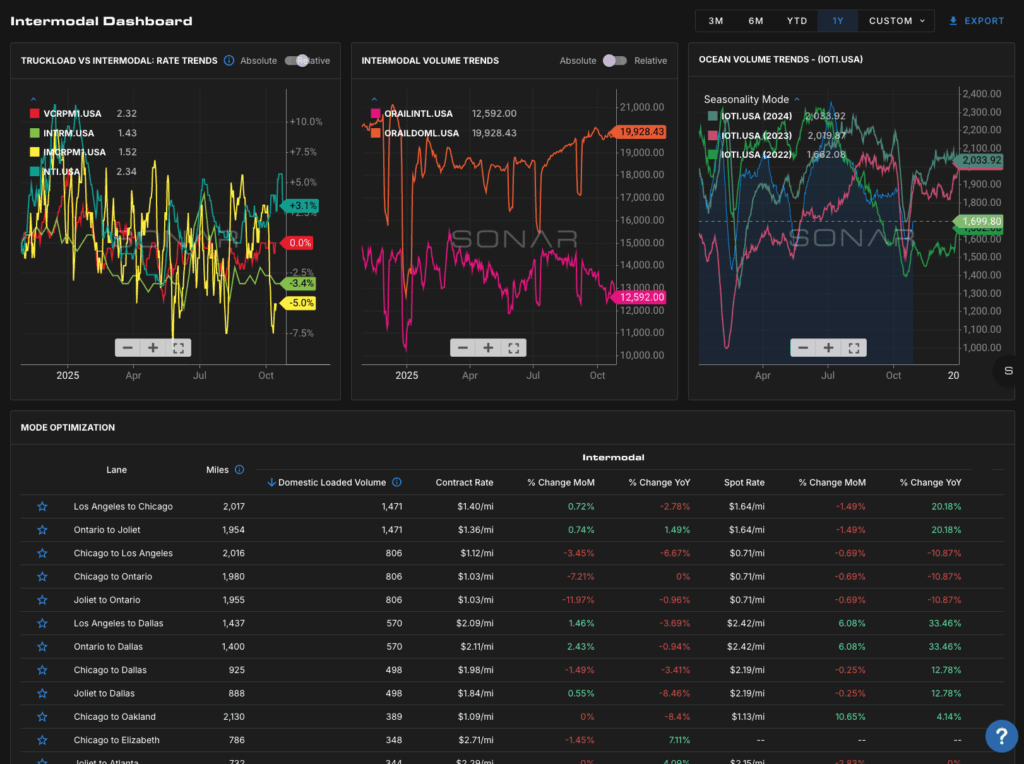

Diving deeper uncovers a more informative story about what is currently happening in the freight market: Goods flowing into the ports are either moving less than 250 miles into warehouses or being loaded onto the rails as intermodal demand remains quite strong for the time being.

Expectations are that from a retailer perspective, this year’s peak season will be fairly strong. The evidence of this? Looking at upstream ordering, volumes leaving overseas peaked at COVID-19-like levels during the third quarter as retailers began bringing goods for the retail peak into the country.

As the calendar gets later and later, time sensitivity ramps up, making certain modes not feasible to ensure goods are on the shelves when consumers are in the store ready to buy. At that moment, transportation turns from just a cost center to revenue preservation. With tools like SONAR, tracking across all the various modes, it becomes easy to identify when others in the industry are changing strategies.

From inventory management to transportation planning, being prepared is essential for success. To ensure smooth operations during peak season, leveraging real-time freight data from platforms like SONAR can give shippers and carriers a competitive edge. Forecasting demand accurately and diversifying carrier options can prevent costly disruptions.

To learn more about how you can utilize SONAR data at your organization, request a demo.