In today’s fast-paced global economy, investors and economists are constantly seeking more accurate and timely data to inform their decision-making processes. SONAR has emerged as a powerful tool in this regard, offering advanced signals for investors on inflation trends. By leveraging high-frequency data from the transportation and logistics sector, SONAR provides unique insights that can help anticipate economic shifts before they become apparent in traditional indicators.

The Power of Real-Time Freight Data

SONAR collects and analyzes data from various sources within the freight industry, including trucking tender data, ocean booking volumes, and more. This information serves as a near real-time proxy for demand in the physical goods economy, offering several advantages over conventional economic indicators:

- Timeliness: SONAR data is updated daily, providing a significant lead time over official publications. For instance, while the U.S. Census Bureau releases its International Trade in Goods and Services report with a five-week delay, SONAR data is available almost immediately.

- Granularity: The data offers detailed insights into specific sectors and regions, allowing for more nuanced analysis of economic trends.

- Predictive Power: By capturing early signals of changes in demand for physical goods, SONAR can help anticipate shifts in inflation and other economic metrics.

Anticipating Inflation Trends

One of the most valuable applications of SONAR for investors is its ability to provide early signals on inflation trends. This is particularly evident in its correlation with key economic indicators such as the PCE Price Index and ISM Manufacturing PMI.

PCE Price Index Forecasting

The Personal Consumption Expenditures (PCE) Price Index is a critical inflation metric used by the Federal Reserve. SONAR data, particularly the Outbound Tender Rejection Index (OTRI), has shown a strong correlation with the durable goods component of the PCE Price Index.

OTRI serves as a proxy for excess demand in the physical goods economy, a key driver of inflationary pressures. The data anticipated both the dramatic increase in durable goods inflation in 2021 and the subsequent disinflation in 2022.

By providing near real-time estimates of excess demand, OTRI can help economists and investors predict changes in durable goods PCE inflation with significant implications for monetary policy and financial markets.

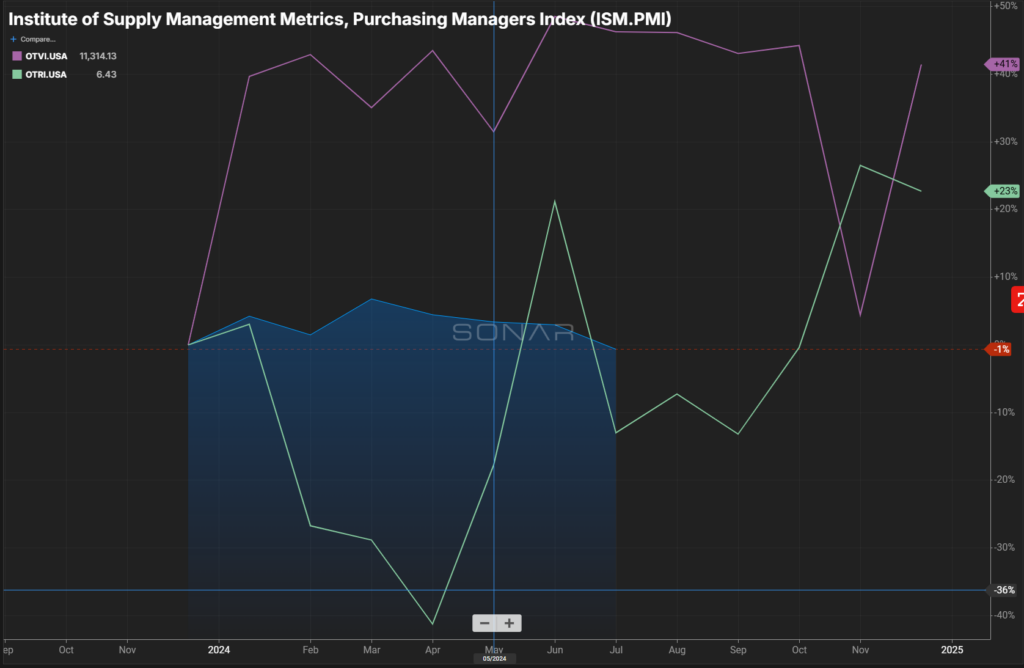

ISM Manufacturing PMI Predictions

The Institute for Supply Management (ISM) Manufacturing Purchasing Managers’ Index (PMI) is a widely followed indicator of economic activity in the manufacturing sector. SONAR’s trucking tender data has demonstrated a strong ability to anticipate trends in the ISM PMI:

- Both the Outbound Tender Volume Index (OTVI) and Outbound Tender Rejection Index (OTRI) show high correlations with the ISM PMI.

- Statistical analysis reveals strong fits between SONAR data and ISM PMIs, with high R-squared values and statistically significant p-values.

- The data has successfully captured major turning points in manufacturing activity, such as the post-COVID recovery in 2020 and the manufacturing slowdown of 2022.

Early Warning System for Economic Shifts

Beyond inflation forecasting, SONAR serves as an early warning system for broader economic shifts. This was particularly evident during the onset of the COVID-19 pandemic in early 2020:

- While official Chinese economic data and global equity markets painted an optimistic picture, SONAR’s Ocean Booking data revealed a significant disruption in Chinese exports.

- The data showed an abnormal decline in outbound booking volumes following the Chinese New Year, signaling severe economic distress well before it was reflected in official statistics or market prices.

This early signal provided users with a crucial advantage in anticipating the global economic impact of the pandemic.

Applications for Emerging Markets

SONAR is particularly valuable for investors focusing on emerging markets, where official economic data can be scarce, delayed, or unreliable. The platform’s global coverage and uniform data collection methods enable robust comparisons across countries and regions.

Case Study: Sri Lanka’s Debt Crisis

In the lead-up to Sri Lanka’s sovereign debt default in 2022, SONAR data provided early warnings of the country’s economic troubles:

- The ratio of import to export tenders dropped significantly in mid-2021, indicating an inability to support goods imports.

- This signal preceded official trade data by several weeks and anticipated the eventual currency devaluation and debt default.

- For distressed debt investors, this information could have provided a crucial edge in positioning ahead of the crisis.

Anticipating Currency Devaluations

In countries with managed exchange rates, SONAR data can help identify foreign exchange shortages that often precede significant devaluations. The case of Nigeria in 2023 illustrates this capability:

- The import/export tender ratio declined sharply from late 2022, indicating a lack of demand for inbound shipments.

- This trend persisted until the Nigerian naira was devalued by 41% in June 2023.

Similar patterns were observed before a subsequent devaluation in February 2024, demonstrating the data’s consistent predictive power.

Conclusion

SONAR represents a significant advancement in economic forecasting and investment decision-making. By providing high-frequency, granular data on physical goods movement, it offers investors and economists a powerful tool for anticipating inflation trends and broader economic shifts. The platform’s ability to capture real-time demand signals, coupled with its global coverage, makes it particularly valuable in today’s rapidly changing economic landscape.

For investors seeking to stay ahead of inflation trends and economic turning points, integrating SONAR data into their analysis can provide a crucial edge. As the global economy continues to evolve, tools that offer timely and accurate insights will become increasingly indispensable for those looking to navigate the complexities of financial markets and economic policy.

If you are interested in learning how SONAR can be helpful in your investment or trading operations, sign up for a demo at GoSONAR.