International intermodal was the main driver of the double-digit growth in Q1 intermodal volume. (Photo: Jim Allen/FreightWaves)

SONAR customers run the gamut from multinational shippers to carriers, logistics companies, consultancies, government agencies, and buy- and sell-side stock analysts. Use cases for the intermodal data in SONAR are similarly varied. Shippers can use intermodal volume data by lane for clues on whether other shippers are seeing value in rail intermodal compared to truckload. Meanwhile, drayage carriers gauge inbound volume, measured at the point of origin, for a look ahead at local demand in the coming days (see blog for detail). In addition, the granular and high-frequency characteristics of SONAR intermodal data help analysts position their portfolios or recommendations ahead of quarterly earnings reports.

Domestic Versus International Intermodal

If you spend much time listening to webinars hosted by the Intermodal Association of North America (IANA), you’ll hear expert Larry Gross say that domestic and international intermodal should be treated as two distinct segments. Within the intermodal industry, the terms “domestic” and “international” pertain to container size, which also segments the industry by carrier segment.

International rail intermodal (also called intact or IPI) refers to the movement of 40-, 20- and 45-foot containers — the same ones that travel overseas on container ships — whereas domestic containerized intermodal refers to the movement of 53-foot containers that never leave North America. Imported goods are moved in both segments — a portion of the freight moving in domestic containers consists of imported goods that have been transloaded from oceangoing containers, typically near the port of entry. The two segments compete with each other over some imported freight; international typically provides shippers with a lower-cost option while domestic often provides faster transit times associated with higher-priority rail service.

Publicly traded multimodal carriers J.B. Hunt, Hub Group and Schneider strictly participate in the domestic side of the market. That makes analyzing upcoming quarterly results by using data from the Association of American Railroads (AAR) and/or the Class I railroads’ investor relations pages misleading. Those data sets, which are published weekly, conflate domestic and international containers and also conflate loaded containers with empty containers that are being repositioned, known as revenue-empties. Data published by IANA provides the proper international versus domestic segmentation, but when I was a stock analyst, I found it to be too backward-looking to be helpful for estimating quarterly earnings.

A Tale of Two Markets

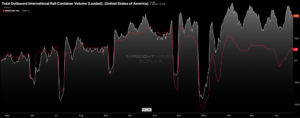

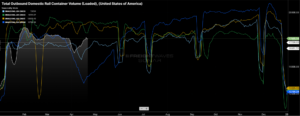

Between the two, the international segment is more heavily influenced by imports clearing customs, whereas the domestic segment is more heavily influenced by the truckload market. So far this year, international intermodal volume has been boosted by strong import volume as shippers looked to replenish inventories. Meanwhile, domestic intermodal volume has been impaired by highly competitive truckload markets, especially for loads that originate and terminate in the eastern third of the US, such as those traveling from Chicago to Atlanta. Container ship lines’ willingness to send large volumes of containers to inland hubs, such as Chicago, is also a telltale sign that there are plenty of oceangoing containers in the market.

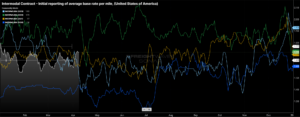

Compared to last year at this time, loaded international intermodal volume (white line) has outperformed domestic intermodal volume (red line).

J.B. Hunt’s Results Reflect Domestic Intermodal Market Conditions

Last week, J.B. Hunt posted a first-quarter earnings miss. I believe part of the reason for the miss was a matter of expectations that were based on volume that more closely resembled the double-digit year-over-year growth reported by the AAR. The volume breakdown in SONAR reveals that the strength in the AAR volume was driven by international volume, a segment that J.B. Hunt does not participate in.

Shares of J.B. Hunt traded down after the company reported earnings on Tuesday. Chart: Barchart.com Inc.

The more widely seen AAR data shows overall US containerized intermodal growth of 14.5% year over year in the first quarter (available in SONAR via the RTOIC.USA ticker).

Against easy year-ago comps, SONAR shows that loaded international intermodal volume increased more than 20% year over year. That is outside of J.B. Hunt’s market but still brings up the widely viewed AAR volume numbers.

Meanwhile, volume for loaded domestic containerized intermodal (ORAILDOML.USA), the market where J.B. Hunt is the largest participant, was elevated 3.2% year over year in Q1. That’s a lot closer to the flat intermodal volume that J.B. Hunt reported.

Analysts can take this analysis a step further by looking at volume by lane. I believe that LA to Chicago is J.B. Hunt’s densest intermodal lane, so analysts should pay particular attention to that in SONAR. Management said its volume in that lane was up by double digits in Q1 — that’s consistent with SONAR showing domestic volume up 19% in Q1.

Meanwhile, volumes in the more competitive Eastern lanes were more muted. For example, loaded domestic intermodal volume in the Chicago-to-Atlanta lane was up less than 1% year over year in Q1, according to SONAR.

SONAR Also Provides Insight Into Domestic Intermodal Pricing

At the same time, the IMCRPM1.USA SONAR ticker shows that rates were down 6.7%, excluding fuel surcharges, year over year in the first quarter. That data set is not a perfect comparison to J.B. Hunt’s financials because its reported revenue per load includes fuel. But it was fairly consistent with the 9.7% year-over-year decline (including fuel) that JBHT reported for intermodal revenue per load in Q1.

To learn more about the intermodal insights contained in SONAR, click here to connect with our team.