Photo by Jim Allen

Post-COVID, everyone is looking for a differentiator. SONAR has been proven time and time again to help transportation providers gain access to knowledge and market insights they may not otherwise have.

Whether you are looking to gain more customers, increase your company revenue size or add more trailers to your fleet, SONAR has information and data to help you with these decisions. There are four core data sets that we discuss with all of our customers as soon as they start training with SONAR:

- Outbound Tender Reject Index (OTRI)

- Outbound Tender Volume Index (OTVI)

- Headhaul Index (HAUL)

- National Van Truckload Index (NTI), Reefer Truckload Index (RTI) and Flatbed Truckload Index (FTI)

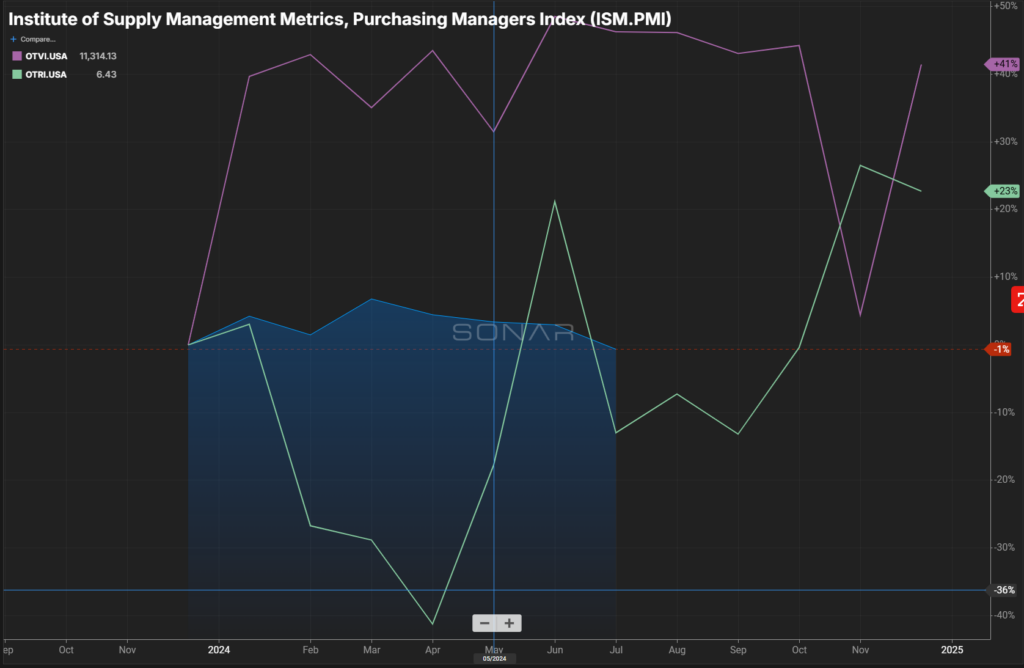

OTRI will provide the percentage of freight that is being rejected out of a market and is an excellent leading indicator for identifying when a market may be heating up with spot freight. Typically, shippers provide a couple of days of tender lead time to transportation providers. If you observe a market where the OTRI percentage is rising day by day, this signals an increase in spot market freight availability in the coming days. As shippers work through their list of contracted providers and if none accept the load, it will likely end up on the spot board.

OTRI can be broken down into the granularities below, providing even more information:

- Equipment type (van, reefer or flatbed)

- Inbound or outbound

- Length of haul (city, local, mid, tweener and long)

- Market level (135)

- State (48)

- Lanes (2600)

- Regional (7)

- Canadian provinces

- National

When looking to track demand in a market, OTVI shows how much freight is being tendered in each market and is reported within a day of tender for optimal accuracy. OTVI was indexed at 10,000 on January 1, 2018, so when looking at this data set, the trend of the line is more important than the actual value. Being able to see if OTVI is increasing or decreasing day over day or week over week can help you identify markets where you may want to solicit freight from your customers or markets where your drivers may be stuck for days.

OTVI can be broken down into the granularities below, providing even deeper analysis:

- Equipment type (van or reefer)

- Inbound or outbound

- Length of haul (city, local, mid, tweener and long)

- Market level (135)

- State (48)

- Regional (7)

- Canadian provinces

- National

Looking at the OTVI of a specific market can provide great insights, but comparing the Inbound Tender Volume Index (ITVI) of that same market paints the whole picture of capacity. SONAR created the Headhaul Index (HAUL), which takes the OTVI of a market and subtracts the ITVI of that same market, which shows the true capacity in that market. The value of the HAUL is an index, which means the value doesn’t really matter — it’s more important to pay attention to the change in that value.

When the HAUL value for a market is positive, that means more outbound freight is being tendered out of that market than inbound freight being tendered into that market. Markets with a positive value are great for carriers and drivers to be in because they will have the buying power as there will be more freight than trucks. When the opposite happens and the value for HAUL is negative in a market, there is more inbound freight than outbound freight. This means anyone securing capacity will have the buying power because there are more trucks than freight in these markets.

The Headhaul Index can be broken down into the granularities below for greater analysis:

- Equipment type (van or reefer)

- Market level (135)

- State (48)

- Regional (7)

- Canadian provinces

- National

After creating TRAC (SONAR’s Trusted Rate Assessment Consortium), SONAR created indices using this data. Users have the ability to see the average national price per truck for van, reefer and flatbed markets (NTI, RTI and FTI). The National Truckload Index (NTI) provides the most recent paid rates (for a van) from our TRAC consortium as of the previous day. There are 12 different variations of this data set, including three forecasts:

- FreightWaves National Truckload Index, 7 Day Average – NTI

- FreightWaves National Truckload Index, Business Day Report – NTIB

- FreightWaves National Truckload Index, Daily Report – NTID

- FreightWaves National Truckload Index, Daily Report (Linehaul Only) – NTIL

- FreightWaves National Truckload Index, Forecast – NTIF

- FreightWaves National Truckload Index, Business Day Report (Linehaul Only) – NTIBL

- FreightWaves National Truckload Index, Daily Report (Linehaul Only) – NTIDL

- FreightWaves National Truckload Index, Forecast 14 Day Outlook – NTIF14

- FreightWaves National Truckload Index, Forecast 28 Day Outlook – NTIF28

- FreightWaves National Truckload Index, Forecast 7 Day Outlook – NTIF7

- FreightWaves National Truckload Index, (Linehaul with fuel base at $1.20 per gallon) – NTIL12

- FreightWaves National Truckload Index, (Linehaul with fuel base at $2.00 per gallon) – NTIL20

The Reefer Truckload Index (RTI) and the Flatbed Truckload Index (FTI) will provide the same information as the NTI data set, only specific to reefer and flatbed freight. Overall, having these rates can help you compare how your company is doing compared to the market rates.

The SONAR platform provides multi-modal data, economic data, FMCSA data and much more, but beyond the data, users also gain the expertise of our Customer Success and Market Expert teams. This ensures that all of our customers have the best understanding of what SONAR can do for their specific company. Our teams are always here to help you understand this ever-changing market and what the data can reveal about the future.

In conclusion, SONAR is an essential tool for 3PLs and carriers looking to gain a competitive edge in the post-COVID transportation market. With its vast array of data sets, SONAR provides unparalleled market insights and data granularity. These tools enable transportation providers to make informed decisions about market demand, capacity and pricing. By leveraging SONAR, 3PLs and carriers can enhance their operational efficiency, better serve their customers and ultimately drive business growth.

Learn more about how you can leverage SONAR at your organization by contacting our team of experts here!