Freight market forecasting is a tricky game these days. Historical freight market data models provide good reference points, but because of the unprecedented nature of COVID-19 (a classic example of a black swan event), we have to rely on current data to understand what is taking place in the freight market. The good news is that this is the very data that SONAR has been building for the past two years.

SONAR’s data comes from a number of disparate sources, but most importantly, electronic tenders. A tender is essentially a request for a truck, sent from a shipper to a trucking company. Tenders are transmitted over EDI or API and are the preferred method in the contract freight market.

The reason this is important is that tenders are transmitted at the time the shipper is requesting a truck, usually a few days before it is to be picked up. The other thing about tenders: they are actual load requests sent from the shipper’s freight routing system (TMS); are not self-reported; and are actual load requests. Tenders are important because they are leading indicators of the direction of the freight market and provide unparalleled freight market insights.

The grocery, consumer packaged goods, and healthcare industries largely operate in the contract market and have consistent freight demand. Beverages and produce are notable exceptions; beverages experience massive seasonal surges (beer, water and soda in the summer, and wine and spirits around the holidays). Produce freight demand is tied to harvest and picking seasons, which vary by commodity and market. FreightWaves built a seasonality calendar in SONAR for this reason.

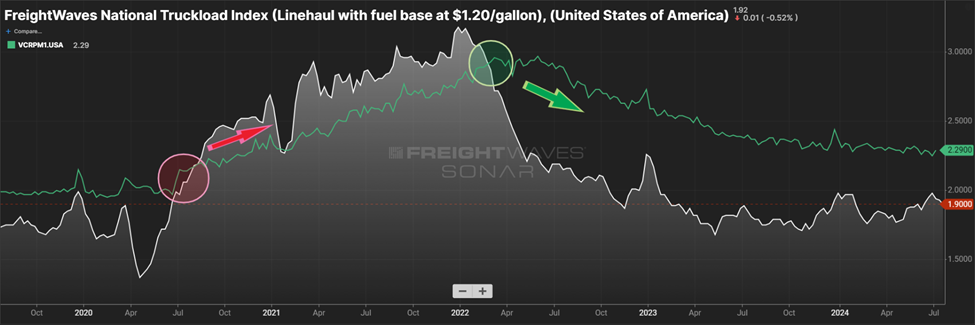

The larger truckload carriers operate mostly in the contract market. They tend to only participate in the spot market when trucking spot rates are high. They also may take spot freight when there are few other load options available to them. Spot market activity won’t return until after the contract market does, so monitoring tender activity gives us a sense of market direction. If you want to know where the spot market is headed, look to outbound tender volumes.

So here is the good news. The contract trucking market seems to be bottoming out. The declines we saw in trucking tenders seem to be leveling off and there are signs of a bottom. This makes sense – most of the economy that shut down due to COVID-19 and shelter-in- place orders are largely offline right now.

SONAR’s outbound tender volume index peaked on March 23, 2020 at 12,939 and is sitting at 8,763 on April 15, 2020, a drop of 32% in contract freight volumes from the peak. The current number is roughly equivalent to its Labor Day 2019 reading. But the slope of the drop is slowing down. To put in technical analysis lingo, the bottom appears to be forming.

In the spot market, things are more dire. Truckstop.com’s seven-day van volume index for the Chicago to Dallas lane is showing equivalent volumes to what you would expect during the Christmas break. This seems to be consistent across most major lanes in the U.S.

Again, we shouldn’t expect the spot market to return to life until after the contract freight market does. Shippers will give volume to their contract carriers first and when they start to reject loads, they will send freight to the spot market. The great news is that we will know it before it happens, by watching tender reject rates.

Gaining spot market insights from the contract freight market is largely a function of understanding the nature of the freight market. In addition to monitoring tender reject rates, our market experts also track tender lead time. This tells us how fast trucks are being requested before they are contracted to pick up. The closer the tender lead time is to pickup, the more urgent the request. If tender lead times compress quickly, the more willing shippers or brokers are willing to pay for a truck in the spot market.

Over the next few weeks, we can expect that the parts of the economy that impact freight demand will start to come back online. Life won’t return to normal, but the trucking freight markets largely will. The reason is that the parts of the economy which are unlikely to return are the ones involved in sectors that generate little freight demand – concerts, events, public sports. In other words, the really fun things that involve large gatherings. Travel is also expected to be all but shut down. All of this will come back eventually, but probably not until there is a coronavirus vaccine.

Restaurant dining will continue to suffer, but in regard to freight movement, demand is largely fungible between grocery and restaurants. In other words, people are still eating food, just from grocery or takeout versus dining at a restaurant.

Manufacturers and retailers will start to come back on board. This will be good for freight demand. There is a significant backlog of orders in manufacturing sectors that have been shut over the past few weeks. Even with demand being curtailed, this will return.

Two stressors are unemployment and consumer sentiment, but this is where the government has stepped up with unprecedented stimulus. The $2 trillion in fiscal stimulus coming from the White House and the estimated $4 trillion in stimulus coming from the Federal Reserve will cycle through our economy. And the U.S. isn’t the only country doing this. Countries all over the world are pumping massive amounts of money into the global economy.

And since consumers are not able to spend their money on experiences and fewer services, they will have more money to spend on goods. And there is one thing that consumers, especially Americans, will do is to spend their money.

In the spirit of offering a transportation rate forecast – freight market demand will return in a few weeks and spot rates will firm starting in May.

For more spot market insights or spot market forecasting, tune into FreightWaves TV. If you are interested in SONAR’s rate forecasting tools, freight spot rates, freight market capacity, tender reject rate, tender lead time data, or transportation rate analysis, sign up for a SONAR demo.