The SONAR team has another “SONAR Indices & Insights.” Each week, you’ll learn about another index found within SONAR, the freight forecasting platform from FreightWaves. This week we’ll highlight the Revenue per driver per week (DRVREV) and how this index allows SONAR subscribers to analyze the effects of truck utilization and freight rates.

The SONAR Revenue per driver per week (DRVREV) index captures the total amount of linehaul and accessorial revenue generated per week, expressed on a “per-driver” basis. Fuel surcharge is excluded from this index. The count of drivers included in the index captures both part-time and full-time employees, as well as independent contractors. For part-time, the counts are reported on a full-time-equivalent (FTE) basis. The carriers reporting the data for this index are participants in the Truckload Carriers Association’s TPP program.

Formula: ((Linehaul Revenue + Accessorial Revenue) / (Driver Count)) / (Weeks in Month)

Using this information as a freight benchmarking figure, SONAR subscribers can get a good idea for how van, reefer and flatbed carriers are navigating the freight market each month. When revenue per driver per week is increasing, carriers are more effectively utilizing their drivers either from increased rates, volumes or equipment and personnel management. There is a correlation between revenue per driver per week and freight market intelligence on activity.

Revenue per driver per week is updated monthly and is based on a sample of over 300 carriers mixed between primarily dry van, flatbed and reefer trailer types. The fleet sizes range from small to large, representing a well-balanced mix of carrier types.

When freight participants in the market understand the revenue per driver per week they can improve truck utilization and increase awareness of the activities in the freight markets that are important to them. Let’s take a look at how various participants use DRVREV to analyze the effects of truck utilization and rates:

The shipping industry needs

a new metric – the Market Rate –

to end the spot vs contract battle</P

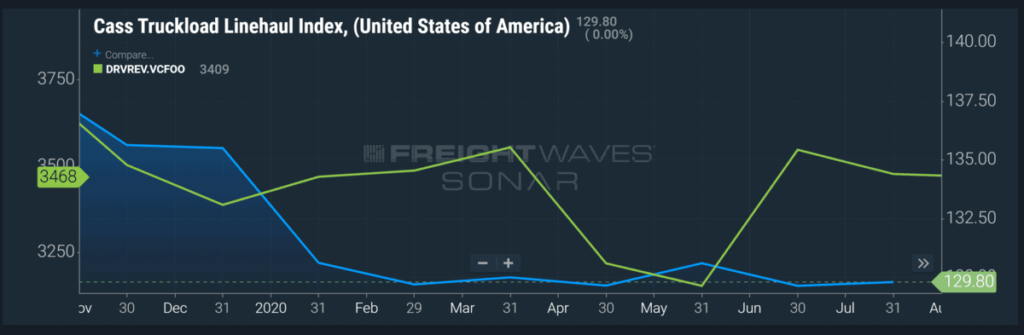

A strong connection exists between the Cass Index and the Truckload Carriers Association revenue per driver per week for its dry van members (DRVREV.VCFOO). Both values peaked in October 2018 and have since fallen back to 2017 levels.

The Cass Truckload Linehaul Index is a measure of pure truckload cost and does not include accessorial charges like detention and fuel. The index is based on freight invoices, which include a large concentration of contracted freight bills.

Unlike the spot freight market, the contracted freight market is much more stable and dependent on annual cycles for the timing of adjustments. Most dry van freight moves under a contracted agreement in which a shipper and carrier agree to long-term pricing in certain lanes if the carrier has capacity. Contracted freight rates drive most of the revenue for dry van carriers.

Typically, carriers do their best to honor their contracted agreements, offering capacity over 95% of the time in stable market conditions – something seen in most of 2019. When it becomes too costly or there are much higher-paying options, carriers can make the financially driven decision to utilize their trucks for other purposes.

This is fair, considering most shippers do not offer loads more than three days in advance, leaving the carrier little time to make network adjustments. A truck can travel around 500 miles per day in low traffic conditions safely, meaning it can take a truck five days to move from New York City to Los Angeles. Managing trucking networks and enhancing truck utilization is the most difficult part of trucking for larger fleets.

In uncertain times, freight market participants need certainty to stay ahead of the freight market and understand the freight demand occurring in each participant’s most important lanes. The freight forecasting engine, FreightWaves SONAR, allows participants to benchmark, analyze, monitor and forecast freight demand and costs to ensure more proactive responses to the market, the ability to provide a solid customer experience by offering transparency, and make decisions, faster. Get a demo of SONAR to see what the platform can do for you.